Guide: How to register a company in Singapore in 2024

- •Step-by-step guide to registering a company in Singapore

- •Why register your company in Singapore?

- •Incorporation services in Singapore: simplifying your business setup

- •Corporate tax in Singapore: what new companies should know

- •Post-registration: navigating your new business in Singapore

- •Frequently asked questions

Singapore has been ranked as the best business environment in the world for the 15th year in a row. The city-state is not just a global hub for trade, financial services, and cutting-edge technology; running a business here is more seamless compared to other countries. The ease of setting up a company in Singapore is a major draw for businesses who want to hit the ground running and build their footprint across Asia.

In this detailed guide, we’ll cover the company registration process in Singapore and the benefits of establishing an offshore company here. We’ll also share advice on how to navigate your newly registered business with the right financial partners.

Step-by-step guide to registering a company in Singapore

Although Singapore has the fastest business registration process in Southeast Asia, it’s important to be well-prepared with the following information:

Step 1: Decide on a business structure

Choosing a business structure is a critical first step, as this will impact your liabilities and tax obligations. The Accounting and Corporate Regulatory Authority (ACRA) offers five types of business entities, which we’ll outline below. You can also use the Go Business e-advisor for guidance on choosing the right structure.

| Sole proprietorship | Partnership | Limited Partnership | Limited Liability Partnership | Company | |

|---|---|---|---|---|---|

| What it is | A business that is owned and controlled by one person or company. | A business that is owned by 2 - 20 partners. The partner can be another person, Limited Liability Partnership, or Company. | A business that is owned by at least 2 partners, with one General Partner and one Limited Partner. |

A business where 2 or more partners create a separate entity that shields co-partners from liabilities | A business with a distinct and separate legal entity from shareholders and directors. There are 7 types of companies that you can register. |

| Setup fees (including SGD 15 fee for company name registration) | SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 | SGD 315 |

| Legal status and liability | Not a separate legal entity. Sole proprietor has unlimited liability. | Not a separate legal entity, Partners have unlimited liability. | Not a separate legal entity. Partners have limited liability for debt but unlimited personal liability for actions of co-partners. | Separate legal entity. Partners have limited liability for debt and are not liable for actions of co-partners. | Separate legal entity. Shareholders have limited liability. |

| Number of partners/shareholders | 1 | 1 - 20 | 2 - unlimited | 2 - unlimited | Maximum number depends on company type. |

| Ease of incorporation | Easy, with few compliance requirements | Easy, with few compliance requirements | Less paperwork and compliance requirements compared to companies | Less paperwork and compliance requirements compared to companies | Most complex incorporation requirements |

| Taxes | Charged as personal tax | Charged as personal tax | Charged as personal tax | Charged as personal tax | Charged as corporate tax |

Sole proprietorship

A sole proprietorship is a business owned and managed by one person. As the simplest business entity in Singapore, it’s the easiest to set up and operate.

Legally, a sole proprietorship is considered the same entity as the business owner. If the business has debt or legal issues, the owner's personal assets could be used to settle these obligations.

A sole proprietorship is ideal for individuals who want to run a small business on their own, such as freelancers, consultants, or small-scale traders.

Partnership

In a partnership, a maximum of 20 individuals or entities come together to run a business. This business structure is typically used by professionals like lawyers or consultants who wish to pool their resources and expertise.

In many ways, a partnership is similar to a sole proprietorship. Both are easier to set up and operate, with fewer regulatory requirements compared to Companies. Both structures also do not have a separate legal entity, which means all partners are liable for debts and legal issues.

A partnership also requires a high level of trust, as all partners are equally liable for the gross misconduct of a co-partner.

Limited partnership

A limited partnership (LP) is a type of enterprise with at least one general partner and one or more limited partners.

The general partner is responsible for managing the business and has unlimited liability for the company’s debts and obligations. In contrast, limited partners contribute capital to the business but do not participate in its management. Their liability is limited to the amount of capital they invested in the LP.

This business structure is ideal for individuals or entities looking to invest in a business without being involved in its daily operations. The LP allows investors to benefit from the profits of the business while limiting their exposure to potential losses. However, there must be one general partner who is willing to bear unlimited liability.

Limited Liability Partnership

A limited liability partnership (LLP) combines some features of limited partnerships and a company. Partners can be corporations, which make it a suitable structure for companies looking to invest. It also operates as a separate legal entity.

Unlike limited partnerships, all partners can participate in the business’s management without facing unlimited liability. This means partners are not personally liable for the company’s debts or the gross misconduct or actions of their co-partners.

However, income from an LLP is treated as though it were a partnership. When each individual receives their share of income, it will be taxed based on individual income tax rates.

Company

Like LLPs, a company is a legal entity that’s separate from its shareholders.

During the incorporation process, you need to state which type of company you are registering. There are 7 types to choose from:

Private limited company (Pte Ltd). The most common company type in Singapore, you can recognize them by company names ending in Pte Ltd. This type of business entity has fewer than 50 shareholders, and their liability is limited to the moneythey invested. This company is not allowed to offer shares to the public.

Exempt private company (EPC). Unlike a Pte Ltd, an EPC cannot have a corporation as a shareholder. EPCs enjoy privileges like exemption from audits if annual revenue is under SGD 5 million.

Unlimited private company. With this entity type, all shareholders are personally responsible for all the company's debts. This means if the company owes money, the owners might have to use their personal assets to pay it off. It's called "unlimited" because there's no limit to how much the owners could be responsible for.

Unlimited exempt private company. All shareholders are also personally liable for all company debts, just like in an unlimited private company. However, it's called "exempt" because it has fewer than 20 shareholders and none of them are corporations.

Public company limited by shares. Entities registered under this type have names that end with "Ltd." and have up to 50 shareholders, whose liabilities are limited to the capital they invested. They can offer shares to the public if they register a prospectus with the Monetary Authority of Singapore.

Public company limited by guarantee. This type of company is usually set up for non-profit purposes, like charities or art societies. Instead of having shareholders, it has members who promise to contribute a certain amount of money if the company has to close down.

Unlimited public company. Just like an unlimited private company, all shareholders are personally liable for the company’s debts. However, an unlimited private company can sell shares to the public and can have any number of shareholders.

Step 2: Choose and reserve a company name

Next, decide on a company name. ACRA recommends avoiding names that are identical to registered businesses, are vulgar or offensive, and prohibited by the Minister of Finance. You can use BizFile+ to see if your desired business name is still available.

When you’re ready with your proposed business name, follow these steps to reserve it:

Prepare the personal particulars of business owners, their contact details, and a description of your business activities.

Login to ACRA BizFile+ with your SingPass or CorpPass details.

Go to “Start a Business” then select “Application for a New Business Name.” Fill in the required details and submit.

Pay the SGD 15 reservation fee using the available payment methods.

Wait for ACRA’s feedback.

Once approved, your business’s name will be reserved for 120 days and you can proceed with registering your entity. If your application is rejected, prepare a different name and submit a new application.

Identify your shareholders, directors and company secretary

As a final step, identify individuals who will fill these key roles. This ensures that your company is properly structured and compliant with legal requirements for company registration in Singapore.

Shareholders

Shareholders are the owners of a company in Singapore. They invest money in the company by buying shares and, in return, they get a portion of the company's profits. Shareholders can be individuals residing in Singapore, individuals living overseas, or companies.

Shareholders have the right to vote on important company matters, such as appointing directors and approving financial statements, at the Annual General Meeting (AGM). They are not usually involved in the business’s daily operations, but have a say in decisions that affect the company's direction.

Directors

Directors are appointed by the shareholders during general company meetings. They manage the company's affairs and have the authority to make strategic decisions on the company’s behalf. They are also responsible for preparing and presenting the company's financial statements.

Each company must have at least one director who resides in Singapore. There is no maximum limit on the number of directors a company can have.

Company Secretary

The company secretary is the company’s main compliance officer and the bridge between shareholders and directors. Their primary responsibility is to ensure the business complies with legal and regulatory requirements.

Company secretaries handle administrative tasks such as maintaining company records, filing annual returns, and organising annual general meetings. A company secretary must be a Singapore resident, and companies must appoint one within six months of incorporation.

Step 3: Prepare the required documents for business registration

To ensure an efficient and seamless registration, prepare the required documents in English. Note that more documents may be needed depending on the entity you’ve chosen:

Approved company name application with transaction number

Brief description of your business activities (include your SSIC Code if you know it)

Valid government IDs and registered addresses for individual partners and directors

If the partner is a company, provide its registration documents, shareholding structure, the authorised representative’s name and their valid government ID

Companies will also need to submit:

Company Constitution

Valid IDs and registered addresses for all shareholders and company directors

Consent to Act as Company Director, signed by all directors

If the shareholder is a company, provide its registration documents, shareholding structure, the authorised representative’s name and their valid government ID

Optional: Valid ID and registered address for Company Secretary

Optional: Consent to Act as Company Secretary, signed by the Company Secretary

Step 4: Register your company on BizFile

BizFile+ is the ACRA business registration service. If you are registering your business yourself, you must use BizFile+ to incorporate your business, as ACRA does not accept in-person applications. You can see a rough process for setting up a company in Singapore below. Note that they may vary slightly, depending on the business type:

Step 1: Click on eServices. On the left-hand menu, select the business type you want to register. Then click “Start a new Business”.

Step 2: Login using your SingPass or CorpPass account.

Step 3: You will see a checklist page. At the bottom, enter the transaction number of the approved name application.

Step 4: Select the validity of your registration (i.e. 1 year or 3 years). Enter your business’s Commencement Date and provide details about your business’s activities.

Step 5: Enter your business address.

Step 6: Enter the name, ID numbers, and contact information for all Shareholders and Directors

Step 7: Depending on the company type you selected, you’ll be asked to Share Capital Details. Enter your primary currency and select your option for Shares Payable.

Step 8: Click on Shareholder Details to allot shares to all Shareholders.

Step 9: Verify all your details on the Preview page and confirm. Otherwise, exit the Preview and make the necessary changes.

Step 10: Click on Make Payment and choose your payment method.

Step 11: The acknowledgement page will be displayed.

Step 5: Open a corporate bank account in Singapore

Once a company is registered in Singapore, looking for business bank account or a business account is a straightforward process. Simply choose a bank with service your business needs, and gather the necessary documents, such as the Certificate of Incorporation and government IDs of partners, directors, and shareholders.

Most banks require a face-to-face meeting to complete the process, but fintech firms like Airwallex offer a convenient and efficient way to open a business account. Just like registering a company through ACRA, opening an Airwallex Business Account can be done fully online, without an in-person visit.

Here’s how to open an Airwallex account in 3 easy steps:

Step 1: Create a free Airwallex business account

Step 2: Upload the required documents and verify your business in Singapore

Step 3: Add funds into your Airwallex account and start using it

With Airwallex, you get more than a multi-currency account; you get a gateway to global growth.

Sign up for an Airwallex business account today.

Why register your company in Singapore?

Unlike global business hubs like New York or London, Singapore is located at the heart of Southeast Asia. This location combined with business-friendly policies creates a vibrant environment for ambitious entrepreneurs. Here are some great reasons to register your company in Singapore.

Pro-business government policies. The Singapore government streamlined the ease of starting and doing business in the country. It takes only 15 minutes to register a business, and companies can benefit from the country’s tax incentives, grants for capability building, and highly skilled workforce.

Economic and political stability. Singapore prides itself on being a trusted and transparent location for business. The local economy is marked by steady growth, low inflation, and a resilient financial system, which shields businesses from regional uncertainties.

Strategic location. Singapore is situated near economic giants China and Korea, and emerging markets like Indonesia. It is also home to one of the world’s busiest container ports, with 20% of global shipping trade passing through its docks annually. Changi International Airport offers direct flights to 300 cities and hosts 150,000 air freight movements annually.

Favourable tax policies. Singapore has a flat corporate tax rate of 17%, one of the lowest in the world. Eligible companies can even enjoy industry-specific tax incentives or tax exemptions. We cover more details about Singapore’s tax framework here.

Incorporation services in Singapore: simplifying your business setup

If you’re a time-strapped entrepreneur or an individual based overseas, you can hire an incorporation service in Singapore to handle the ACRA company registration. These firms are a one-stop-shop for the incorporation process, with services like:

Preparation of required documents, including a Company Constitution.

Provision of a business address or registered office address.

ACRA company registration and purchasing the Certificate of Incorporation.

On-going post-registration support services like creating a company chop, opening a business bank account, and preparing post-incorporation documents.

Company Secretary services for administrative tasks, such as Annual Return Filing and maintaining statutory records.

Some firms you can explore are:

Osome is an incorporation service that specialises in startups and small entrepreneurial ventures by foreigners. They also offer accounting and company secretarial services.

Sleek is an all-in-one SME digital platform for local and foreign entrepreneurs. They offer a range of services from company incorporation to visa applications.

ContactOne offers incorporation, secretarial, compliance, and company deregistration services for local SMEs.

Hawksford is a corporate services provider for early-stage businesses, multinational corporations, and family offices.

Corporate tax in Singapore: what new companies should know

Singapore's corporate tax framework is known for its simplicity and business-friendly policies. On top of the flat 17% corporate tax rate, qualifying new companies can enjoy tax exemptions and incentives. These features further reduce the tax burden, making it easier to invest in growth and development.

Start-up Tax Exemptions

Singapore offers tax exemptions to support the growth of new enterprises. For the first three years of assessment, qualifying new start-up companies can enjoy a 75% exemption on the first SGD 100,000 of normal chargeable income and a further 50% exemption on the next S$100,000. This allows start-ups to reinvest more of their earnings back into the business.

To qualify for Start-up Tax Exemptions, the business must fulfil these criteria:

Be incorporated in Singapore

Are a tax resident for that year of assessment (YA)

Have 20 or fewer shareholders holding the company’s total share capital

The newly incorporated company must not be:

A company primarily engaged in investment holdings; or

A company involved in property development for sale, investment, or both

Tax incentives

New businesses in Singapore should pay attention to the tax incentives offered by the new Enterprise Innovation Scheme (EIS). This scheme offers deductions or allowances for qualifying expenses on activities that drive economic development and innovation:

Research and development in Singapore

Registration of intellectual property

Acquisition and licensing of IP rights

Training

Innovation projects carried out with polytechnics, the Institute of Technical Education, or other qualified partners.

By leveraging the EIS, new businesses can accelerate the development and implementation of innovative ideas without worrying about generating profit for shareholders.

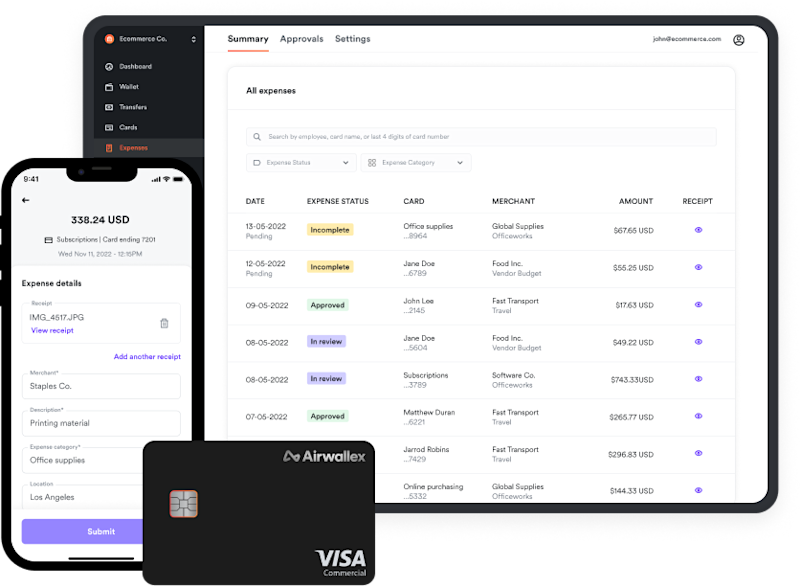

How to optimise for a better tax position

It’s critical to manage your tax obligations so it aligns with your overall goals. Maintaining accurate and organised financial records is key to optimising your company’s tax position. This practice allows you to identify all eligible tax deductions or exemptions, while providing the necessary documentation to support your tax filings. Tax advisors or accountants can assist with tax planning and compliance. For accurate record-keeping, leverage the technology offered by fintech platforms like Airwallex. Its dashboard shows a comprehensive financial overview of all payments coming in and going out across currencies and markets. Airwallex also has a built-in Expense Management tool automatically categorises each expenditure, simplifying the process of identifying which expenses are tax-deductible. Having a consolidated view of all your bill payments also helps you spot tax-saving opportunities.

By hiring experts and adapting technology, you can optimise your tax position and further support your business’s financial health.

Benefits of setting up an offshore company in Singapore

Besides the flat corporate tax rate, liberal free-market policies make Singapore a prime destination for offshore companies. Foreigners can own 100% of a company’s shares without enlisting citizens as partners or shareholders.

Here are some other advantages of setting up an offshore company in Singapore:

Favourable tax policies for offshore companies. Unlike other financial hubs, Singapore doesn’t charge capital gains tax. Offshore companies also don’t pay additional taxes on income remitted to the country thanks to Singapore’s Double-Taxation Agreements (DTA) with other nations. Singapore also offers Unilateral Tax Credits (UTC) to tax resident companies, shielding them from double taxation when trading with nations where no DTA exists.

Flexible corporate governance. At least one company director must be a Singapore-based citizen, permanent resident, or EP holder. However, other directors can be based overseas. International businesses can also appoint a professional director or nominee director to satisfy the local director requirement.

Political and economic stability. The city-state’s fiscal policies and robust legal system creates a stable environment for business. Companies engage in long-term planning and investment without the risk of sudden policy shifts or political turmoil.

Easy access to capital and investors. Singapore remains the region’s biggest venture capital market, capturing 60% of Southeast Asia’s total funding in 2023. This access to investors supports business expansion efforts in this highly competitive market.

To facilitate a smooth Southeast Asia expansion, offshore companies can use business payment specialists like Airwallex. Airwallex’s all-in-one Business Account simplifies international payments by allowing businesses to hold, receive, and pay in multiple currencies, all within a single account.

Currency accounts with local bank details can be created instantly, so businesses can receive foreign currency payments without unnecessary conversion into SGD. These features reduce the need for multiple accounts and saves companies the hassle of creating local bank accounts in markets where they operate.

Post-registration: navigating your new business in Singapore

Upon successful registration, ACRA will send a confirmation email. This email serves as your official Singapore Certificate of Incorporation and it will include your business registration number. If you require a hard copy of the certificate, you can request one from ACRA for SGD 50.

Then, follow these final steps to ensure full compliance and manage your operations effectively:

Appoint a Company Secretary if you haven’t done so. You need to have a Company Secretary within 6 months of registering your company.

Apply for business licences. Depending on your business’s activities, you may need specific licences or permits before starting operations.

Register for Goods and Services Tax (GST). If your business expects to earn more than SGD 1 million in the next 12 months, you must register for GST and submit supporting documents for your forecast. Regular filing of GST returns is required once registered.

Comply with annual filing requirements. Companies are required to file annual returns with ACRA and tax returns with IRAS. Staying compliant with these requirements is crucial for maintaining your company's legal status.

Comply with employment regulations. When hiring employees, remain compliant with Singapore’s Employment Act, which covers terms of employment and other conditions. You must also contribute to the Central Provident Fund (CPF) for Singaporean employees.

How to make sure your business’s financial operations can scale globally from day 1

Business owners have a variety of banking partners to choose from, and Airwallex presents a compelling alternative to legacy banks. Its Business Account has everything a new company needs to operate within Singapore and Southeast Asia:

Instantly create foreign currency accounts online with the Airwallex Global Account - no in-person visit needed. This allows you to collect and hold payments from customers in over 13 currencies, which eliminates unnecessary conversion into SGD. It also helps you operate seamlessly in different markets without the hassle of creating a local bank account.

Fast, low-cost cross-border payments with Airwallex Transfers. Unlike traditional banks, who rely on the SWIFT network for international transfers, Airwallex has a global payout network that’s connected to local payment rails in 110 countries. Cross-border payments are treated like local transfers, which means low fees and transfer times as fast as 1 business day.

Market-leading exchange rates and currency risk management. Airwallex lets businesses trade currencies using market-leading rates, which means you don’t pay the markup charged by banks for foreign currencies. It also has tools for managing foreign exchange risk, allowing you to lock in and transact at your desired rate.

Transform your financial operations with Airwallex.

Frequently asked questions

1. Can foreigners register a company in Singapore without residing there?

Yes, foreigners can register a company in Singapore without residing here. They are required to appoint a local resident director, but the foreign owner can manage the company from abroad and visit Singapore as needed.

2. What is the minimum capital requirement for registering a company in Singapore?

A minimum capital requirement of SGD 1 is needed to start a private limited company.

3. How much does it cost to register a company in Singapore?

The cost of registering a company varies according to company type and the registration period. All fees below include the SGD 15 fee for company name registration.

| Sole proprietorship | Partnership | Limited Partnership | Limited Liability Partnership | Company | |

|---|---|---|---|---|---|

| Registration fees | SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 for 1-year registration SGD 175 for 3-year registration |

SGD 115 | SGD 315 |

4. How long does the company registration process typically take in Singapore?

The company incorporation process is efficient, often taking less than an hour via the ACRA's BizFile+ system, provided all required information and documents are in order. However, the overall process may take a few days to a week if additional licences or permits are needed.

5. Can I register a company in Singapore with a virtual office address?

Yes, you can use a virtual office address, as long as it is a physical address where you can receive official correspondence. You must also check that the address is approved for commercial use and complies with the Urban Redevelopment Authority's (URA) regulations.

6. Are there any industries in Singapore that require special licenses for company registration?

Yes, several industries require special licences for company registration, such as financial services, food and beverage, education, and healthcare. Browse all licences at the Go Business website.

7. What are the ongoing compliance requirements for a registered company in Singapore?

These are the mandatory compliance requirements that you should follow after registration: Estimated Chargeable Income - filed 3 months after your Financial Year End (FYE)

Annual General Meeting (AGM) - held 6 months from FYE

Annual Returns Filing - filed after AGM and within 7 months of your FYE

Tax Form C or C-S - filed every Year of Assessment by 30 November

8. How can I change my company's business structure after registration in Singapore?

You can make changes to your company's business structure by submitting an application through the BizFile+ system. Depending on the changes, you may need to go through additional steps, such as revising your business constitution. Learn more at Go Business.

9. What are the implications of not complying with ACRA's filing requirements

Failing to comply with ACRA's filing requirements can result in penalties, fines, and even legal action against the company and its officers. Learn more at ACRA.

10. Can a sole proprietorship in Singapore be converted into a private limited company?

Yes, a sole proprietorship in Singapore can be converted into a private limited company. You’ll need to register a new private limited company and transfer the assets and liabilities of the sole proprietorship to the newly formed company.

11. How does GST registration work for newly registered companies in Singapore

Newly registered companies must register for Goods and Services Tax (GST) if their annual taxable revenue exceeds SGD 1 million or if they expect to exceed this threshold in the next 12 months. Learn more at IRAS.

Useful sources:

https://www.gobusiness.gov.sg/licences/find-licence-by-agency/

https://www.gobusiness.gov.sg/home-based-businesses/take-your-biz-further

https://www.acra.gov.sg/how-to-guides/setting-up-a-local-company

Related articles about starting your own business:

Share

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.